What happens when a single spreadsheet cracks the facade of a multi-billion-dollar empire? Margin Call (2011) doesn’t give you explosions, car chases, or climactic courtroom scenes. Instead, it hands you quiet panic, suit-clad desperation, and moral ambiguity that chills you long after the credits roll. This isn’t just a movie; it’s a time capsule from the eve of the 2008 financial meltdown, a mirror we’re still afraid to look into.

Directed with razor-sharp restraint by J.C. Chandor in his breakout debut, the film throws us into a day and night at a nameless investment bank that’s perilously close to imploding. It begins with pink slips, ends with market bloodshed, and in between, it stitches together the death rattle of Wall Street in whispers, meetings, and dead-eyed calculations. If you’ve ever wondered what greed looks like in the fluorescent light of an executive boardroom, this film hands it to you without blinking.

What makes Margin Call unforgettable isn’t its setting but its silence; the eerie calm of people realizing they’re about to unleash financial havoc and choosing to do it anyway. It’s not about villainy; it’s about something colder: self-preservation. Every decision made over that fateful 24-hour stretch feels like a quiet betrayal, not just of others but of ethics itself.

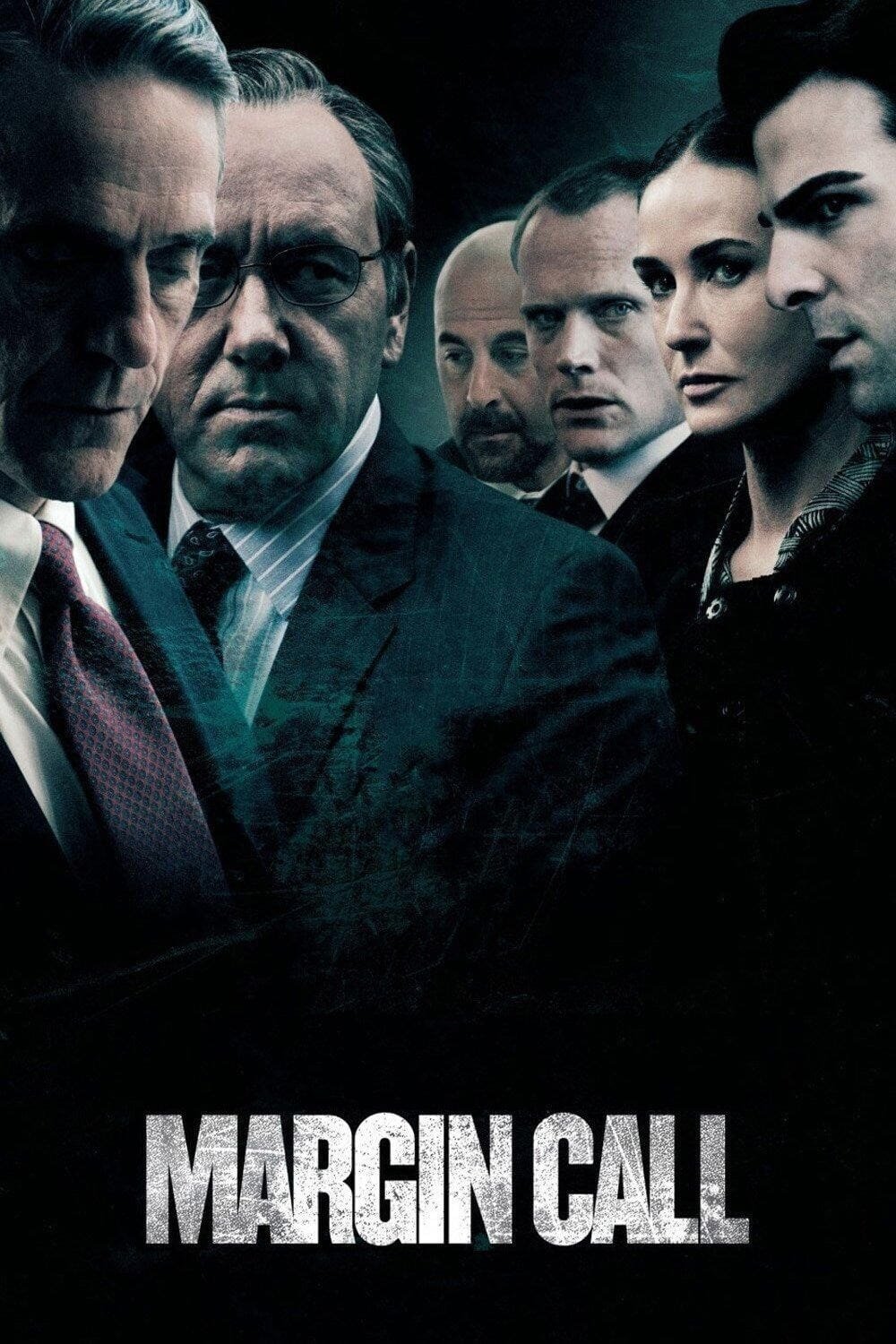

The cast, stacked with gravitas; Kevin Spacey, Jeremy Irons, Paul Bettany, Zachary Quinto, and Stanley Tucci; never lets you look away. Each character is a study in denial, compromise, or cold calculation. There’s no moral compass here, just sliding scales of rationalization wrapped in suits and liquidity risk.

In a world where stock markets rise and fall on whispers, Margin Call is not just a film; it’s a psychological thriller dressed as a business drama. It’s a corporate horror story with no ghosts, only numbers. It dares to ask, “What would you do if you knew your company was about to bring down the economy?” And its answer is far too human.

Quick Notes

- Crisis Management, Reimagined: The movie compresses the early hours of the 2008 financial crisis into one breathless corporate night, showing how power is wielded quietly behind closed doors.

- Morality vs. Money: Every character faces a choice between ethics and survival. Most don’t hesitate long—and that’s the disturbing beauty of it.

- Emotionally Icy, Intellectually Brutal: This isn’t a tearjerker; it’s an existential slap. The film trades drama for devastating realism, revealing how institutions function when humanity checks out.

- Masterclass in Leadership Dysfunction: Margin Call lays bare the fragile egos, ignorance, and rationalizations of those who run billion-dollar machines with blind faith in flawed models.

- Business Education in a Script: You don’t need an MBA to appreciate this film, but you’ll walk away with lessons no business school dares to teach aloud.

A Single Click That Broke the Bank

It all begins with a cardboard box. As the company begins mass layoffs, seasoned risk analyst Eric Dale (played by Stanley Tucci) is escorted out; an unceremonious exit for a man who once held the company’s secrets in his head. On his way out, he hands a USB drive to Peter Sullivan (Zachary Quinto), a junior analyst with a background in rocket science. That single handoff becomes the catalyst of the entire movie’s slow-burn chaos.

Peter opens the files and discovers a catastrophic truth: the firm is massively over-leveraged. If the market shifts even slightly, the firm’s losses will exceed its entire market capitalization; bankruptcy is not just likely; it’s imminent. What unfolds next is a feverish sequence of boardroom meetings, hushed confrontations, and thinly veiled panic as the firm’s senior leaders attempt to grasp the scope of their impending doom.

The tension is not in explosive decisions, but in the excruciating moments between discovery and action. Sam Rogers (Kevin Spacey), the weary head of sales, finds himself torn between loyalty to the company and basic decency. Jared Cohen (Simon Baker) and Sarah Robertson (Demi Moore) scramble to minimize personal liability. The real chessboard, however, belongs to CEO John Tuld (Jeremy Irons), who arrives like a vulture with a private helicopter and a pragmatic philosophy: “Be first, be smarter, or cheat.”

As night turns to dawn, the firm makes its choice. Dump the toxic assets before the market catches on, no matter the consequences. The sales team is told to sell, knowing full well they’re unloading worthless garbage. Bonuses are dangled, justifications are whispered. The scene plays like an apocalypse launched with coffee cups and spreadsheets.

By the time the sun rises, the die has been cast. Markets will tremble, careers will crumble, and yet the boardroom is already quiet again. For those who made the call, it was just another day of business.

Key Lessons and Insights to Learn from the Movie

Margin Call doesn’t hand you a moral compass. It shows you one, bent and broken, lying under a spreadsheet. One of its most chilling insights is that large systems often collapse not due to malevolence, but through routine negligence. Everyone in the firm saw pieces of the problem, but no one put the puzzle together or cared enough to act until it was far too late. It’s a wake-up call to any industry relying solely on upward trends and algorithmic trust.

Another sobering takeaway is how leadership can mask cluelessness with confidence. CEO John Tuld may be commanding, but his understanding is skin-deep. He doesn’t know the numbers; he just knows when to pull the trigger. It’s a sobering reminder that in many high-stakes situations, charisma often outweighs competence. Leaders are sometimes actors playing executives, counting on others not to look too closely.

The film also holds up a mirror to the rationalization of unethical behavior. From Sarah Robertson’s sterile justifications to Jared’s passive shrugs, we see how easily professionals convince themselves they’re just “doing their job.” The crisis becomes everyone’s problem so no one’s fault. This isn’t just a Wall Street issue; it’s a human one, replicated in boardrooms and bureaucracies worldwide.

Perhaps the most profound message comes from Sam Rogers, whose internal battle represents the last flicker of conscience within the firm. He knows what they’re doing is wrong. But he also knows that speaking up won’t stop the machine; it will only ruin him. His dilemma isn’t heroic. It’s heartbreakingly relatable. Most people don’t want to be villains, but they’d rather be complicit than unemployed.

Margin Call reaffirms that financial systems are human systems. Behind every trade, every number, every crash, are people making choices. Not always maliciously. Sometimes blindly. Often selfishly. If we want resilient systems, we must begin with courageous individuals; those willing to say, “Stop,” before it’s too late.

The Calm After the Corporate Storm

When Margin Call ends, it doesn’t offer closure. No fireworks. No redemption. Just a quiet burial. In one of the final scenes, Sam Rogers, grief etched across his face, buries his dog in his ex-wife’s yard. It’s a moment that sums up the soul of the film: the aftermath isn’t dramatic; it’s devastating in its ordinariness. Collapse doesn’t come with thunder; it comes with paperwork and paw prints in the mud.

Unlike most financial thrillers that rush toward a courtroom showdown or a regulatory reckoning, Margin Call chooses the road less traveled. It shows what really happens behind the glossy walls of institutions: people rationalize, they negotiate, and eventually, they forget. The crisis doesn’t leave a moral vacuum; it creates a new normal. One where accountability evaporates and survival becomes the new ethical code.

For viewers hoping for a clear antagonist or an uplifting third act, the film delivers a punch to the gut instead. That’s its genius. It doesn’t pretend the system will change because of a moment of conscience. There are no caped crusaders here. The people who caused the mess walk away richer. The people who stayed silent get bonuses. And the rest of the world? Left holding the bill. The film resists Hollywood’s urge to moralize and instead presents a mirror: cold, clear, and unflinching.

What makes the film such a masterpiece is how it refuses to scream its message. It whispers it—through uncomfortable silences, icy stares, and conversations that matter more for what’s unsaid. It trusts the viewer to connect the dots, to feel the rising nausea of realizing these events weren’t just plausible; they already happened. And could happen again.

Margin Call doesn’t leave you feeling better. It leaves you smarter. And maybe a little angrier. Because once the final credits roll, you’re no longer just a viewer; you’re a witness. To power misused, to ethics bent beyond recognition, and to a reality that’s scarier than fiction: those with the most power often carry the least accountability.

Disclaimer

It’s also critical to remember that whether the Movie is either a work of fiction or a real-life depiction, it must be emphasized that the actions depicted within are not encouraged in reality and shouldn’t be imitated. The review aims to analyze the storytelling, characters, and business decisions portrayed in the Movie solely for educational and entertainment purposes. Any ethical & unethical practices highlighted in the Movie are not endorsed by the Esyrite publication.

Why scroll… When you can rocket into Adventure?

Ready to ditch the boring side of Life? Blast off with ESYRITE, a Premier Management Journal & Professional Services Haus—where every click is an adventure and every experience is enchanting. The ESYRITE Journal fuels your curiosity to another dimension. Need life upgrades? ESYRITE Services are basically superpowers in disguise. Crave epic sagas? ESYRITE Stories are so wild, your grandkids will meme them. Want star power? ESYRITE Promoted turns your brand cosmic among the stars. Tired of surface-level noise? ESYRITE Insights delivers mind-bending ideas, and galactic-level clarity straight to your inbox. Cruise the galaxy with the ESYRITE Store —a treasure chest for interstellar dreamers. Join now and let curiosity guide your course.