It starts innocently enough. A big idea, a crisp pitch deck, maybe a dream fueled by late-night caffeine and startup podcasts. But then, reality walks in wearing a pinstripe suit and holding a term sheet. If you’re trying to build something that lasts, the moment of truth arrives when you ask: who gets to call the shots; your lender or your investor? One offers you lifeblood. The other demands a seat at the table. And that, my friend, is where the real game begins.

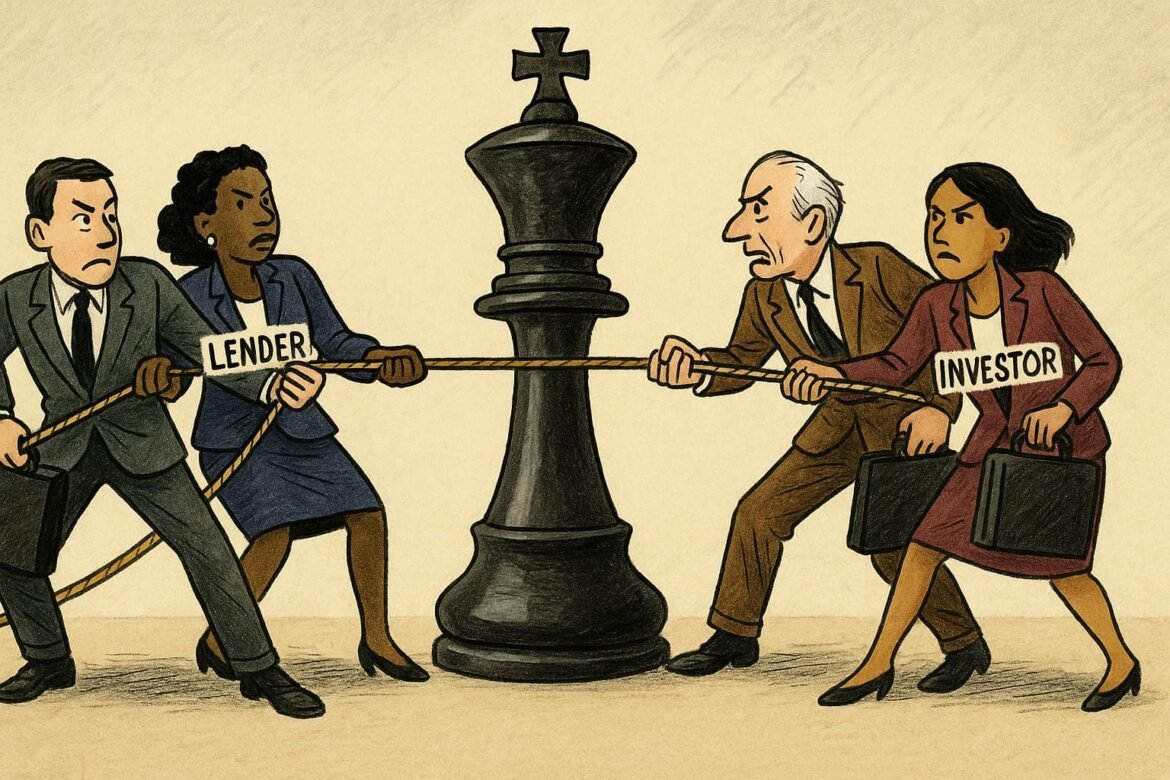

Control isn’t written in your mission statement. It’s hidden in your capital stack. For every business owner chasing growth, the fiscal tug-of-war between debt and equity becomes more than a financial decision. It shapes your future, your autonomy, and your soul as a founder. From Main Street cafes to Silicon Valley titans, this question keeps leaders up at night. Because the truth is simple and terrifying: whoever funds your dream just might own it.

But what if we told you the real power doesn’t lie with who gave you the money but how you use it, what strings are attached, and what future you’re bold enough to design? Welcome to the fiscal deep dive they don’t teach you in school.

Quick Notes

- Equity grants influence, not charity: Investors often own part of the business and thus help steer it but that doesn’t always mean you lose control if you know how to structure your deal.

- Debt seems cold and simple: but it has hidden teeth. Lenders might not sit on your board, but covenants, penalties, and timelines can quietly suffocate innovation.

- Founders must master the dance: A savvy entrepreneur knows how to play both sides, mitigating risk, maximizing leverage, and keeping control.

- Your business stage dictates your best ally: Startups, scale-ups, and legacy businesses need different kinds of fuel. Choosing the wrong one can stall you or worse.

- Real power lies in foresight: Knowing where your business is going (and who you want with you) is the key to making the right fiscal choice that doesn’t own you in return.

The Courtship of Capital: Who’s Got the Ring?

The relationship between a founder and a funder starts like any romance: full of charm, promises, and shared dreams. Investors woo with visions of exponential growth, network access, and strategic partnerships. Lenders bring structure, predictability, and interest rates that won’t dilute your ownership. But like every relationship, there’s baggage. Venture capitalists expect more than returns; they want alignment. Bankers don’t care about your story; they want repayment.

Sam Altman once said, “Raising money is selling a piece of your company.” That’s not hyperbole; it’s a fact. Equity investors, unlike lenders, gain ownership, which means influence over decisions, direction, and sometimes even leadership. They’ll ask for board seats, veto powers, and preferred shares. This may feel like a partnership, but it’s also an audition you’re never done performing.

Debt, by contrast, seems simpler on the surface. You borrow, you repay. But lenders don’t offer love; they offer leverage with caveats. Financial covenants can restrict your hiring plans, limit dividend payments, or force specific operational decisions. Miss a milestone, and your business could default into chaos.

Many founders are seduced by the short-term ease of either route without calculating the long-term implications. Equity is permanent. Debt is patient but unforgiving. And both carry costs that go beyond the monetary. The ring might be flashy, but ask yourself can you live with it long-term?

This is where the myth cracks: capital isn’t just about access to money. It’s about a marriage of expectations. And once that honeymoon phase ends, you’ll need more than ambition to survive the reality of shared control.

The Illusion of Freedom: Debt’s Silent Grip

Debt is often sold as the entrepreneur’s best friend. No equity dilution, predictable costs, and full operational control on paper, it sounds like the golden ticket. But beneath the glossy surface lies a web of limitations that can choke your business before it ever scales.

Remember the cautionary tale of WeWork’s collapse? Before Adam Neumann’s infamous downfall, there were hidden clauses and ballooning debts that turned financial independence into a boardroom firestorm. While WeWork chased valuation glory, debtors lurked in the shadows, waiting for missed payments and violations. Eventually, the leash yanked tight.

Lenders aren’t villains, but they are risk-averse. To protect their capital, they enforce rigid structures: interest coverage ratios, liquidity thresholds, and performance triggers. One bad quarter can invoke penalties, force asset sales, or even demand repayment. That’s not freedom; it’s quiet captivity.

Cash flow-based businesses like restaurants and retail chains feel this pressure acutely. A single disruption like a supply chain hiccup or inflation surge can trigger a default spiral. And while debt might not dilute equity, it can still force founders to give up control when covenants are breached.

So, ask yourself: are you truly free if your decisions are dictated by spreadsheet formulas and payment schedules? The hidden truth about debt is that it whispers compliance while demanding obedience. For many, that’s a deal with the devil disguised in a crisp banker’s smile.

Equity’s Friendly Fire: The Hidden Cost of Giving It All Away

Equity is seductive. It feels like empowerment; a belief that someone backs your vision so much they want to own part of it. But equity doesn’t come without expectations, and once it’s given, it rarely comes back.

Just ask the early team behind Twitter. Founders gave away significant stakes in the early days to secure funding. By the time the company soared, the original vision had morphed into something else entirely; one shaped by new hands at the wheel. Ownership was fragmented, control was diluted, and the mission took a back seat.

Investors may smile during pitch meetings, but they’re calculating behind the scenes. They don’t invest for charity; they invest for control, ROI, and exit strategies. Every funding round comes with terms: liquidation preferences, anti-dilution clauses, and board rights. These aren’t accessories; they’re tools of influence.

That’s not to say equity is evil. Strategic investors bring immense value if they align with your long-term mission. The challenge lies in distinguishing between true allies and opportunists with short-term incentives. A well-structured equity deal can launch you to greatness. A bad one can turn your dream into someone else’s asset.

So before signing that term sheet, step back. Who will benefit most if this business goes public, gets acquired, or scales globally? If the answer isn’t “you and your team,” then maybe equity is a cost you can’t afford.

Founder Strategy: Dancing with Wolves Without Getting Eaten

The smartest founders aren’t choosing between debt and equity. They’re orchestrating them both, like instruments in a symphony, knowing when to play which note for maximum impact. Capital strategy is a chess game, not a coin toss.

Shopify’s founder Tobi Lütke famously refused aggressive venture funding in the company’s early days. Instead, he focused on building a profitable, sustainable model, only taking on investment when it made strategic sense. That decision preserved autonomy and helped Shopify scale without sacrificing its soul.

A hybrid approach using revenue-based financing, convertible notes, or SAFE agreements can buy time, flexibility, and learning. These tools allow founders to delay equity conversations until valuations are higher or avoid restrictive debt covenants in critical growth phases. Strategy, not urgency, should drive your funding roadmap.

Leaders who master fiscal fluency treat investors like partners, not saviors, and lenders like stakeholders, not dictators. They read every clause. They negotiate every term. They build runway buffers. They refuse to be cornered.

It’s not about avoiding capital; it’s about understanding it deeply enough to own it. Business isn’t a charity or a gamble. It’s a strategic war where the best players know how to bend capital to their will not the other way around.

The Long Game: Building a Business That Can’t Be Bought

In the end, the true boss isn’t your lender or investor. It’s the vision that outlasts them. Founders who anchor their decisions in purpose, not panic, are the ones who endure. They attract the right money, at the right time, for the right reasons.

Take Patagonia. Yvon Chouinard didn’t chase hyper-growth or flashy IPOs. He built a company rooted in values, and when he passed on the reins, he did it in a way that ensured Patagonia’s mission lived beyond profit. His backers didn’t own him; his mission did.

Legacy businesses aren’t built by those who chase capital, but by those who wield it. Capital is a tool, not a crown. Used wisely, it empowers. Used carelessly, it enslaves. Founders who internalize this truth build ventures that thrive not just in bull markets, but in downturns, crises, and revolutions.

So the next time someone asks, “Who’s really the boss?” smile. Because if you’ve done it right, the answer is simple: you are. Not because you own 100% but because your decisions, your vision, and your values are what truly drive the business.

Ask yourself: are you raising capital to build something that needs you or something that will outlive you?

Why scroll… When you can rocket into Adventure?

Ready to ditch the boring side of Life? Blast off with ESYRITE, a Premier Management Journal & Professional Services Haus—where every click is an adventure and every experience is enchanting. The ESYRITE Journal fuels your curiosity to another dimension. Need life upgrades? ESYRITE Services are basically superpowers in disguise. Crave epic sagas? ESYRITE Stories are so wild, your grandkids will meme them. Want star power? ESYRITE Promoted turns your brand cosmic among the stars. Cruise the galaxy with the ESYRITE Store —a treasure chest for intergalactic dreamers. Dare to enter ESYRITE.COM and step into a universe like no other. Ready to blast off?